The Central Bank of Nigeria (CBN), has revoked the licenses of 4,173 Bureaux De Change (BDC), operators due to their failure to comply with regulatory requirements.

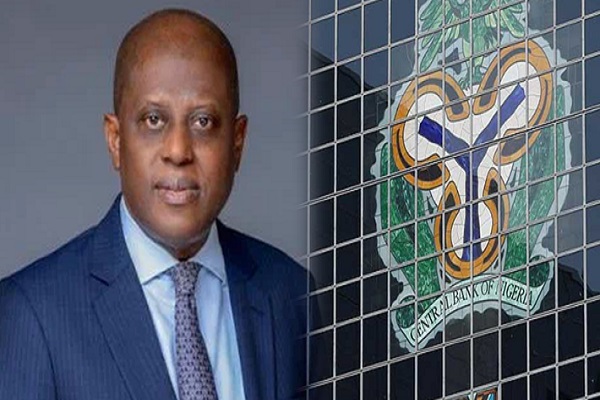

This announcement was made through a statement by the CBN’s Acting Director of Corporate Communications, Sidi Ali Hakama, has reverberated throughout the financial sector, sparking discussions on regulatory compliance and industry oversight.

To revoke these licenses stems from the failure of the affected BDC operators to adhere to the regulatory provisions outlined by the CBN. Such as the timely payment of necessary fees, including license renewal fees, and the submission of required returns in accordance with established guidelines.

Moreover, the operators in question have been found wanting in their compliance with critical directives and circulars issued by the CBN, particularly those pertaining to Anti-Money Laundering (AML), Countering the Financing of Terrorism (CFT), and Counter-Proliferation Financing (CPF) regulations.

Underpinning this action is the CBN’s authority derived from the Bank and Other Financial Institutions Act (BOFIA) 2020, Act No. 5, and the Revised Operational Guidelines for Bureaux De Change 2015. By exercising these powers, the CBN reaffirmed its commitment to upholding the integrity and stability of the financial system.

Further details and the list of affected BDC operators has been made available on the CBN’s official website.