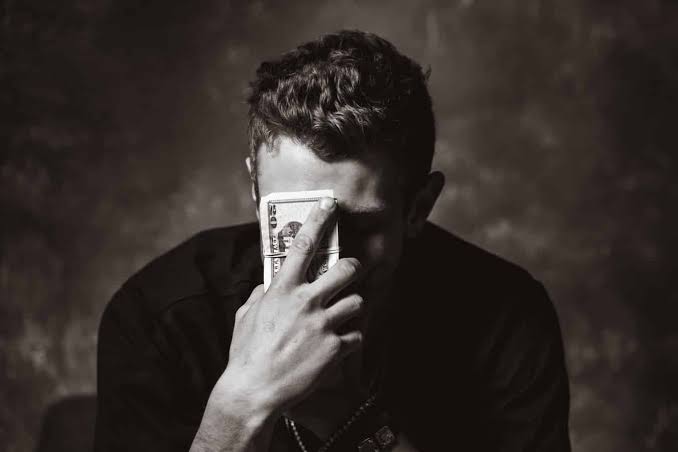

Financial challenges are top drivers of poor mental health but you don’t have to wait for better conditions to improve your mental state.

If you have felt depressed or anxious due to finances, you are not alone. In a recent study by MetLife, 40 percent of employees in the U.S. say that debt and getting into debt drive most mental health problems.

Moreover, finance behavior experts say that emotions drive financial decisions 80-90 percent of the time. Making money is also tied to one’s cognitive and emotional abilities further entangling finances with mental health.

Viewed this way, no one is immune to these stresses. The only difference is in the extent to which it affects each person.

Therefore, attaching mental and emotional wellness to financial stability is not a good idea. Nevertheless, financial therapist, author, and speaker Lindsay Bryan-Podvin shares tips on how to make your mental health independent of financial conditions.

Fix Your Relationship with Money

This goes back to how money was/is handled and discussed in your family. During formative years, experiences with money or lack thereof can condition us on how we think about money throughout life.

Use Financial Health Resources For Support

Search for a personal favorite medium to support you. Blogs, books, podcasts, and apps, to guide you on financial wellness.

Get Rid of Small Costs to Support Big Financial Goals

Focus on the small things you can control. Thinking about big financial decisions can increase anxiety and paralyze action.

For example, you can reduce subscriptions. On the other side, you should not cut costs on physical well-being and health.

Managing Debt and Financial Challenges

Despite a healthy relationship with money, financial stress will come up at different stages of life.

When tackling a financial concern like a large debt, it’s important to consider striking a balance between being laser-focused on making progress to repay and acknowledging that some spending does bring value and make you feel good. It doesn’t have to be an all-or-nothing approach,” says Bryan-Podvin.

This calls for a three-step plan for personal finance

Income and spending budget.

Track your income and what you are spending on necessities.

Maintain a fund for short-term needs

This is money you can fall back on for emergencies like job loss or medical emergencies. It includes money you save for trips, a car, etc.

Have a future fund

You will feel more secure and in control if you invest in a retirement plan.

Takeaway

You cannot separate your emotions from your finances. However, you can change those emotions from fear and anxiety to confidence, excitement, and peace. Positive emotions are attached to better financial choices and experiences.