The federal government’s proposal to use pension funds to address the infrastructure deficit in the country has sparked various reactions.

As of the end of March 2024, pension funds in Nigeria amounted to N19.66 trillion, according to data from the National Pension Commission.

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, hinted at the plan following a Federal Executive Council meeting on Tuesday. The proposal includes tapping into these funds to help bridge the housing deficit.

However, a report by Daily Trust indicates that current guidelines from the National Pension Commission do not allow the federal government to directly take pension funds. Instead, these funds can only be invested in approved securities.

Eligible investment instruments and asset classes include quoted ordinary shares of publicly listed companies, FGN/State/LG debt securities approved by the Securities and Exchange Commission (SEC), money market instruments, fixed deposits, tenured placements, bankers’ acceptances issued by financial institutions, commercial papers issued by corporate entities, and specialized/managed investment funds like real estate investment trusts and exchange-traded funds.

Development finance expert Musa Ibrahim emphasised that the guidelines clearly delineate the types of investments permissible for pension funds. “It is also the prerogative of the pension fund operators to decide whether to invest in the particular items the federal government is proposing, as they cannot be coerced,” he said.

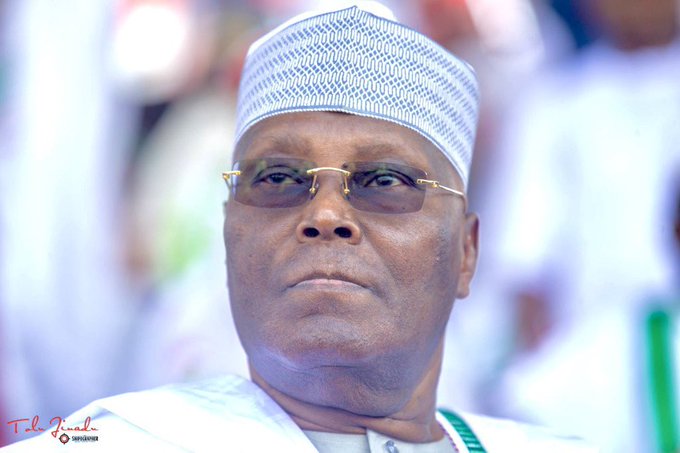

Atiku Abubakar, the presidential candidate of the Peoples Democratic Party (PDP), also weighed in on the issue through his X handle. He stated, “There is no free Pension Fund that is more than 5% of the total value of the nation’s pension fund for Mr. Edun to fiddle with. There are no easy ways for Mr. Edun to address the challenges of funding infrastructure development in Nigeria. He can’t cut corners.

He must introduce the necessary reforms to restore investor confidence in the Nigerian economy and leverage private resources, skills, and technology.”

The debate continues as stakeholders express concerns and call for clear, strategic approaches to utilizing pension funds for national development without compromising the security and intended purpose of these funds.