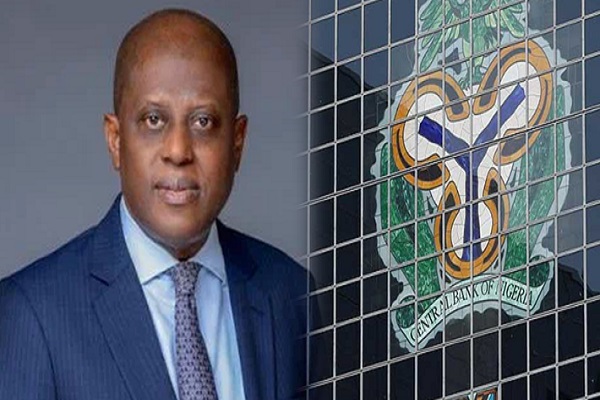

In a bid to tackle the ongoing economic challenges in Nigeria, the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, declared that the apex bank will cease providing Ways and Means advances to the Federal Government until previous loans are fully repaid.

Cardoso emphasised that this decision is part of a comprehensive strategy aimed at addressing the economic downturn plaguing the country.

He made this announcement during a meeting with the Senate Committees on Finance, Appropriations, Banking, Insurance, and Other Financial Institutions, alongside the economic team.

The move comes amidst concerns over the free fall of the Naira and the surge in food prices. The economic team, comprising key figures such as the Minister of Finance, Wale Edun, the Minister of Budget and Economic Planning, Atiku Bagudu, and the Minister of Agriculture, Abubakar Kyari, was summoned by the Senate to address these pressing issues.

During the meeting, Cardoso highlighted the inflationary pressures fueled by factors such as an increased money supply and quasi-fiscal measures. He underscored the importance of adhering to legal limits on Ways and Means advances and outlined measures taken by the CBN to stabilise the economy.

Moreover, Cardoso outlined the CBN’s inflation-targeting policy and efforts to enhance foreign exchange liquidity, including measures to curb speculative forex demand and boost USD supply. He expressed optimism that these measures, coupled with improved agricultural productivity and global supply chain easing, would lead to a decline in inflation to 21.4% in 2024.

Additionally, senators raised concerns about the efficacy of previous interventions and urged for accountability and transparency in managing economic challenges. They called for concrete plans to strengthen the Naira, reduce dollarization, and address pressing issues such as food inflation and labour unrest.

In response, Cardoso assured the Senate of the CBN’s commitment to stabilising the economy and emphasised the need for collaboration between the fiscal and monetary authorities. He pledged to provide audited accounts of the apex bank and collaborate with relevant stakeholders to address the concerns raised.

Overall, the announcement marks a significant step in Nigeria’s efforts to navigate its current economic difficulties and underscores the importance of coordinated action to achieve sustainable economic stability.