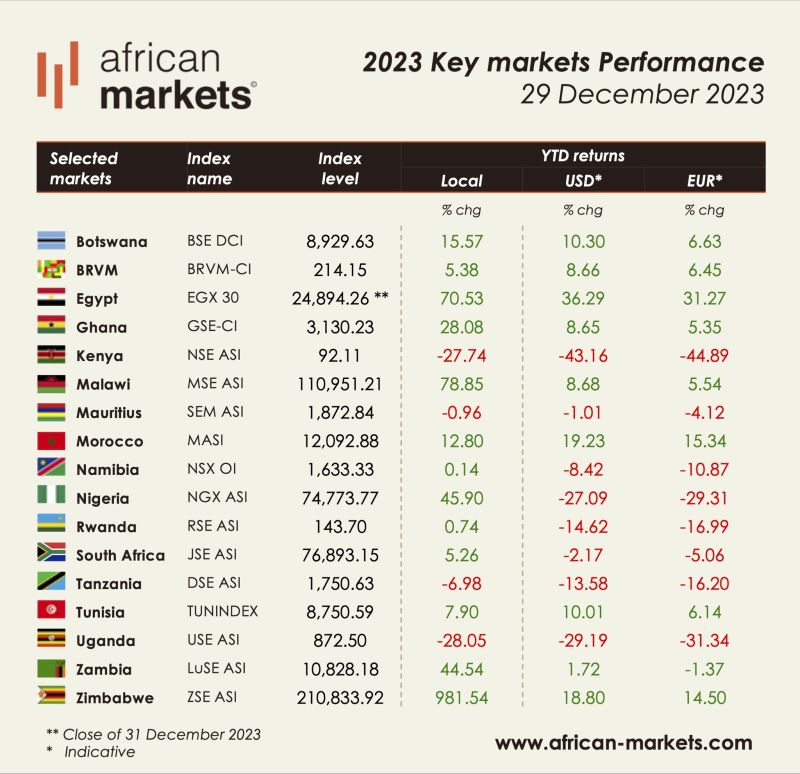

In a retrospective analysis of Africa’s stock markets for the year 2023, notable trends and standout performers have emerged.

The figures below illustrate the percentage changes in key markets, reflecting the dynamism of the continent’s economic landscape:

1. Zimbabwe 🇿🇼: +981.54% (Standout Performer)

2. Malawi 🇲🇼: +78.85%

3. Egypt 🇪🇬: +70.53%

4. Nigeria 🇳🇬: +45.90%

5. Zambia 🇿🇲: +44.54%

6. Ghana 🇬🇭: +28.08%

7. Botswana 🇧🇼: +15.57%

8. Morocco 🇲🇦: +12.80%

However, not all markets experienced positive growth, as reflected in the following declines:

1. Uganda 🇺🇬: -28.05%

2. Kenya 🇰🇪: -27.74%

The standout performance of Zimbabwe, with an impressive increase of 981.54%, distinguishes it as a noteworthy player in the African stock market arena. Malawi, Egypt, and Nigeria also posted substantial gains, reflecting robust economic activity.

Conversely, Uganda and Kenya faced challenges in 2023, with declines of -28.05% and -27.74%, respectively. Understanding the factors behind these downturns will be crucial for investors navigating the African market in 2024.

As we venture into the new year, the diverse landscape of African stock markets presents limitless opportunities for investors.

Navigating these opportunities requires a nuanced understanding of each market’s dynamics, offering the potential for strategic investments and growth in 2024.