In a significant move aimed at tightening monetary policy, the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) has announced a substantial increase in the benchmark interest rate by 400 basis points to a historic high of 22.75%.

.

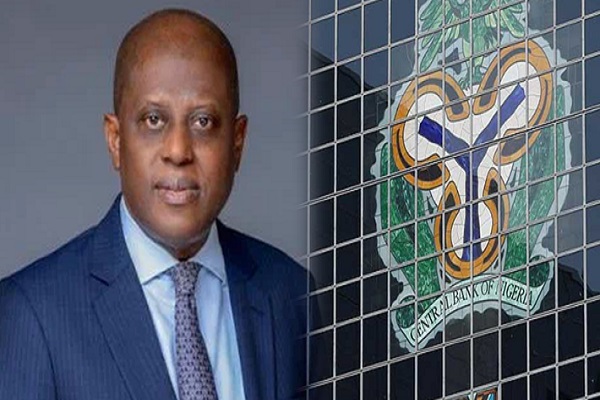

The decision was unveiled by CBN Governor Olayemi Cardoso during the first MPC meeting of the year held in Abuja.

Following a two-day session, Cardoso revealed that the committee unanimously voted to adjust the asymmetric corridor around the Monetary Policy Rate (MPR) to +100 to -700 basis points, up from the previous range of plus 100 to -300 basis points.

Additionally, the cash reserve ratio was raised from 32.5% to 45%, while the liquidity ratio was maintained at 30%.

The latest adjustment marks a significant departure from the previous MPC meeting in July 2023, chaired by former acting governor Folashodun Shonubi, where the MPR was raised by 25 basis points to 18.75%. Since May 2022, the MPR has progressively increased from 13% to its current level.

Financial analysts’ expectations ahead of the meeting were surpassed by the magnitude of the rate hike, as revealed in a Reuters poll predicting two aggressive interest rate hikes within a short span to combat inflation and bolster the Nigerian currency.

Despite trading near record lows on the black market, the local currency’s resilience is being tested amidst the tightening monetary policy stance.

President Bola Ahmed Tinubu’s stance advocating for reduced interest rates to stimulate investment and consumer spending contrasts with the MPC’s decision to further tighten monetary policy. This move underscores the CBN’s commitment to curbing inflationary pressures and stabilizing the economy.

Further details and reactions to the MPC’s decision are anticipated as the implications of the rate hike unfold.