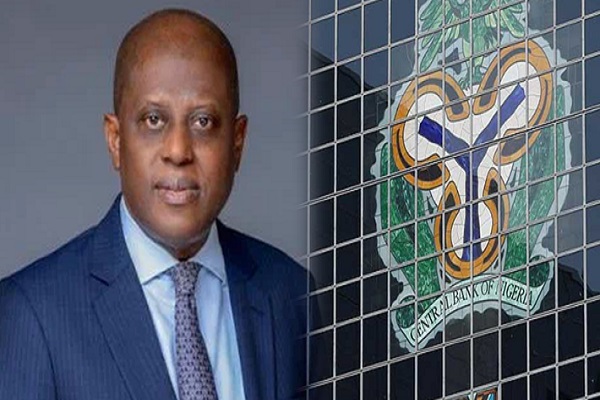

The Central Bank of Nigeria (CBN) has successfully cleared the $7 billion foreign exchange (FX) backlog inherited by Governor Yemi Cardoso.

This accomplishment fulfils a pivotal pledge made upon his appointment, marking a crucial step towards revitalising trust in the nation’s economy.

According to a statement released on Wednesday by Mrs. Hakama Sidi Ali, the CBN’s Acting Director of Corporate Communications, all valid FX backlog claims have been settled.

The CBN engaged Deloitte Consulting, an independent auditing firm, to meticulously assess the transactions, ensuring that only legitimate claims were honoured.

Ali further emphasised that any invalid transactions were promptly referred to the appropriate authorities for further investigation.

The CBN’s steadfast commitment to addressing the FX backlog is yielding positive results. External reserves have witnessed a significant surge, reaching $34.11 billion as of March 7, 2024, marking the highest level recorded in the past eight months.

This remarkable month-on-month increase is attributed to a notable uptick in remittance payments from Nigerians abroad and an increase in foreign investment in local assets, particularly government debt securities.

These proactive measures undertaken by the CBN align with the broader strategy outlined during the recent Monetary Policy Committee (MPC) meeting, reflecting the central bank’s proactive stance in navigating economic challenges and fostering sustainable growth.

Details will follow shortly as developments unfold.