Sub-Saharan African nations, with Nigeria at the forefront, have been issued a cautionary note by the International Monetary Fund (IMF), regarding their economic affiliations with China. This warning comes amidst reports indicating that Nigeria’s debt to China had risen to $4.73 billion as of June 30, 2023.

Nigeria’s External Debt to China Sees Significant Increase

Data from the Debt Management Office (DMO), reveals a substantial increase in Nigeria’s debt to China, surging by $800 million in just one year. As of June 30, 2022, the debt stood at $3.93 billion, climbing to $4.73 billion by June 30, 2023. This debt is associated with concessional loans secured by the Nigerian government for the financing of various infrastructural projects spanning power generation, railways, water supply, airport terminals, agricultural processing, and communication.

Projects funded by Chinese loans include the Nigerian National Public Security Communication System, the Wu-Kaduna section of the railway modernization project, Abuja light rail project, Nigerian Information and Communication Technology infrastructure backbone project, airport terminals expansion in Abuja, Lagos, Kano, and Rivers, Zungeru hydroelectric power project, 40 parboiled rice processing plants, Lagos–Ibadan railway modernization, and the rehabilitation/upgrading of the Abuja-Keffi-Markurdi road.

Evolving Economic Ties Between Nigeria and China

The growing indebtedness of Nigeria to China underlines the strengthening economic relations between the two countries. According to Chinese Ambassador to Nigeria, Cui Jianchun, bilateral trade between Nigeria and China surged by nearly 142% from 2016 to 2021. In the first ten months of 2022, bilateral trade volume reached $20.04 billion, cementing Nigeria as China’s third-largest trading partner in Africa, while China remains Nigeria’s largest source of imports.

IMF’s Caution on Vulnerabilities

In the IMF’s most recent Regional Economic Outlook, released in October 2023, a cautionary note was raised regarding the vulnerabilities faced by Nigeria and other Sub-Saharan African nations due to their extensive economic connections with China.

The IMF noted that while China has been a major credit provider and a significant source of foreign direct investment in the region, there are potential dangers on the horizon. The recent economic slowdown in China is expected to adversely affect trading partners in Sub-Saharan Africa, including Nigeria.

The IMF emphasized that the anticipated future deceleration in China’s growth could negatively affect African trading partners, primarily through reduced trade. Furthermore, funding for infrastructural projects may be jeopardized if China scales back its commitments to Sub-Saharan African countries. Currently, China is a primary source of funding for infrastructure development in African countries, including Nigeria.

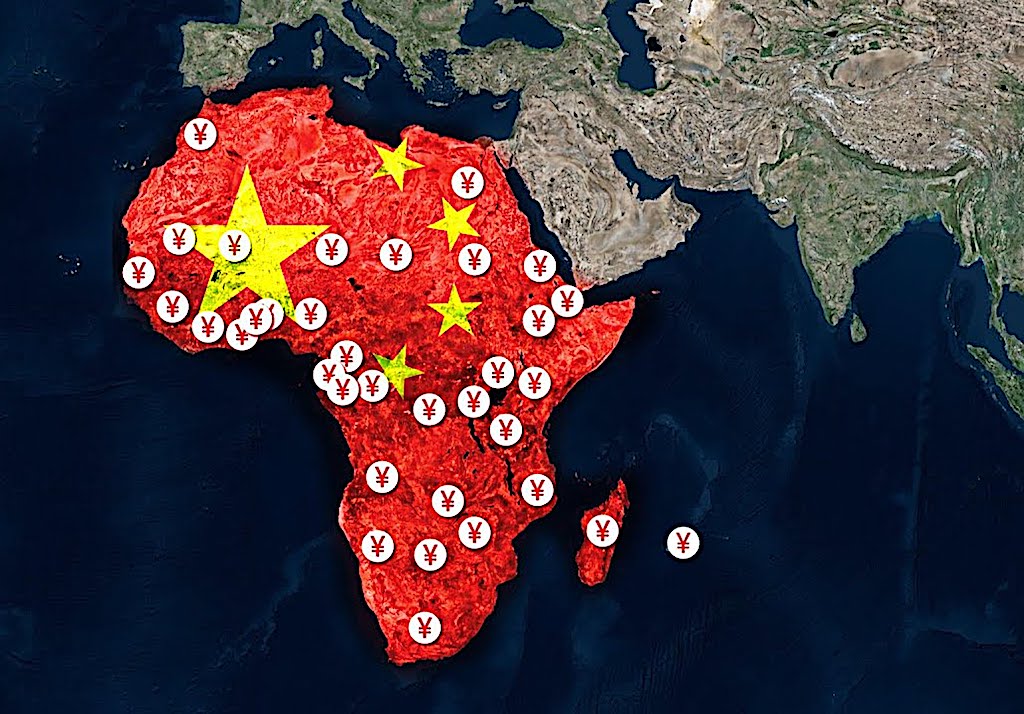

China’s Growing Role in African Debt

China has increasingly become a major funding source for African governments since the early 2000s. Chinese loans, mainly directed towards financing public infrastructure projects, have seen rapid growth in the region. Consequently, China’s share of total sub-Saharan African external public debt has risen from less than 2% before 2005 to about 17% in 2021.

The IMF identified five countries – Angola, Kenya, Zambia, Cameroon, and Nigeria – as accounting for 55% of official Sub-Saharan African debt to China.

The IMF also acknowledged that Chinese lending to Sub-Saharan Africa has been subject to criticism, particularly concerning the imposition of relatively harsh terms on debtors and the use of natural resources as collateral. Concerns also extend to the lack of standardization and transparency in public debt, as Chinese lenders do not systematically document loans to individual overseas borrowers, resulting in significant data gaps.

Nigeria’s Reassurances and IMF’s Focus on Debt Restructuring

The Nigerian government has repeatedly reassured that loans obtained from China come with lenient terms. However, concerns emerged in 2020 when the controversial ‘waiving sovereignty’ clause in a commercial loan agreement between Nigeria and the Export-Import Bank of China was reported, raising questions about Nigeria’s sovereignty.

The IMF observed that Sub-Saharan African countries facing debt distress or high-risk debt distress constituted about 40% of the total public debt stock to China at the end of 2020, prompting a need for debt restructuring. The IMF noted that debt restructuring negotiations for some countries have been slow and challenging.

With China currently experiencing a decline in economic growth, the IMF warned that Sub-Saharan Africa could face spillovers from this slowdown. The IMF’s latest projections show an average annual growth of only about 4% in the next five years for China, with a shift toward reduced investment and greener technologies.

To mitigate potential dangers, the IMF advised Sub-Saharan African countries to adapt to evolving economic ties by increasing regional trade integration, strengthening policy frameworks to reduce macro-economic vulnerabilities, promoting economic diversification, and creating favorable business environments.

Mixed Reactions to IMF’s Warning

Economists and financial analysts have expressed mixed views regarding Nigeria’s risk exposure due to its economic ties with China. Some argue that the concerns are disproportionate and that Nigeria should focus on addressing its domestic economic challenges, such as rising debt levels and high debt servicing costs. They stress that China’s economic outlook is not a major issue for Nigeria at the moment.