Eight Nigerian Banks Meet CBN’s New Capital Requirements Ahead Of 2026 Deadline.

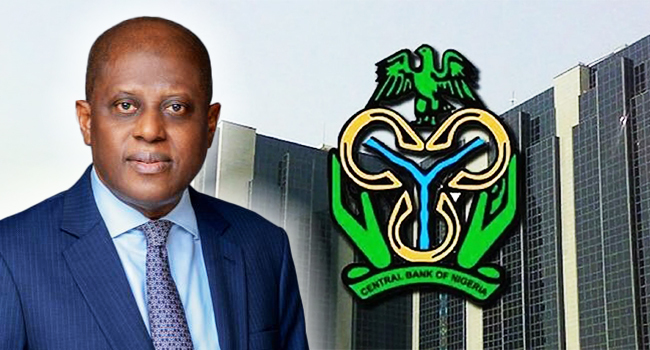

The Central Bank of Nigeria (CBN) has announced that eight Nigerian banks have successfully met the minimum regulatory capital requirements under the current forbearance regime, marking a significant milestone in the nation’s ongoing banking sector recapitalisation programme. The disclosure was made by CBN Governor Olayemi Cardoso during the Monetary Policy Committee (MPC) briefing on Monday, 22 July 2025, in Abuja, with the compliance deadline set for March 2026.

Cardoso highlighted the achievement as a testament to the banks’ commitment to strengthening their financial resilience amid Nigeria’s challenging economic landscape, characterised by inflation, naira depreciation, and exposure to high-risk sectors. While the CBN governor did not name the eight banks, he praised Guaranty Trust Holding Company (GTCO) for raising substantial capital through a public listing on the London Stock Exchange (LSE), a move that underscores the growing international confidence in Nigeria’s banking sector.

The recapitalisation initiative, launched to bolster the capital base of Nigerian banks, aims to enhance their ability to withstand economic shocks and support the government’s ambition of achieving a $1 trillion GDP by 2026. The CBN’s forbearance measures, introduced during the COVID-19 pandemic, provided temporary relief by allowing banks to restructure loans and defer certain prudential requirements. However, with the economy stabilising, the CBN is phasing out these measures, requiring banks to submit comprehensive Capital Restoration Plans by 14 July 2025 to ensure full compliance.

According to industry analysts, the banks’ success in meeting the new thresholds reflects proactive efforts to clean up balance sheets and provision for risky loans, particularly in sectors like oil and gas. GTCO and Stanbic IBTC, for instance, have already exited the forbearance regime by writing off affected exposures, with GTCO provisioning 80% of its forbearance loan book. The CBN’s directive to suspend dividend payments, executive bonuses, and foreign investments for banks still under forbearance has further driven capital preservation, ensuring resources are retained to meet regulatory standards.

The announcement has sparked optimism about the future of Nigeria’s financial sector. Cardoso noted that the country’s external reserves have risen to $40.11 billion as of 18 July 2025, providing 9.5 months of import cover, bolstered by improved oil production and non-oil exports. This financial stability, coupled with the banks’ progress, positions the sector to finance large-scale projects and drive economic growth.

While challenges remain, including potential increases in non-performing loans as forbearance measures are phased out, the CBN’s focus on stringent oversight and prudent risk management is expected to foster a more robust banking landscape. The success of these eight banks signals a positive outlook, with the market eagerly awaiting the official list of compliant institutions to further boost investor confidence.