The crypto industry is buzzing with anticipation following former U.S. president Donald Trump’s recent promise to fire Securities and Exchange Commission (SEC) Chair Gary Gensler if reelected.

Trump, once a vocal critic of cryptocurrencies, is now courting the industry, promising significant policy shifts that have garnered enthusiastic support from crypto advocates.

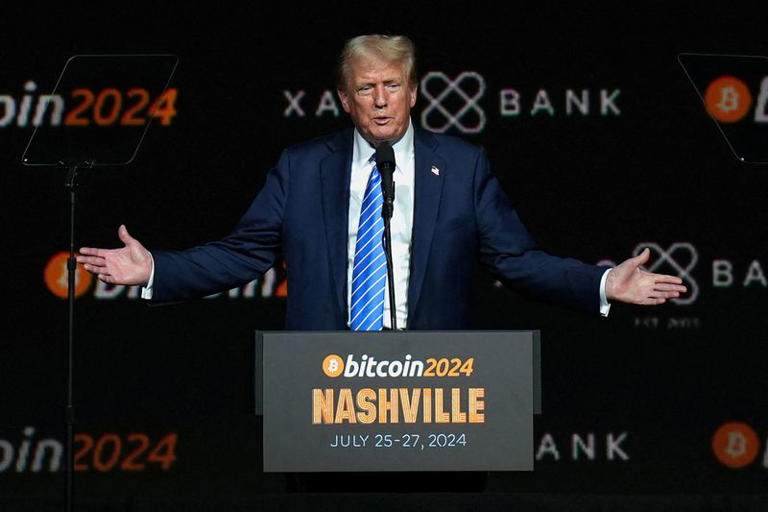

During a bitcoin conference, Trump’s commitment to replace Gensler, known for his stringent crypto regulations, was met with roaring applause. Gensler, appointed by President Biden, has led a vigorous enforcement campaign against major crypto exchanges like Coinbase, Binance, and Kraken, imposing hefty fines and tightening regulations.

Crypto leaders, including Kristin Smith, CEO of the Blockchain Association, are optimistic about the potential changes a second Trump administration could bring.

“The most important thing we want out of a new administration is the nomination of individuals to key positions that have an appreciation and an understanding of crypto,” Smith emphasized.

Key figures in the crypto world are advocating for the appointment of Hester Peirce, a pro-crypto SEC commissioner, as acting chair.

Additionally, industry insiders are pushing for Brian Brooks and Chris Giancarlo, both prominent crypto supporters from Trump’s first administration, for the permanent SEC chair position.

A new chair could swiftly rescind the 2022 SEC guidance that requires public companies to treat crypto assets held for others as liabilities, a rule that has posed significant challenges for banks. “I believe that’ll be rescinded Day One of the Trump administration,” stated Cody Carbone, chief policy officer at the Chamber of Digital Commerce.

The industry is also pushing for a safe harbor from SEC registration rules for issuing and trading crypto tokens, a proposal initially floated by Peirce in 2020. Peirce and Giancarlo have both expressed support for creating a regulatory framework that fosters innovation while protecting investors.

Despite the optimism, the power of a new SEC chair would be contingent on the political makeup of the commission, currently dominated by Democrats critical of crypto. Major policy changes may require a Republican majority, which could delay significant reforms.

Trump’s campaign senior advisor, Brian Hughes, confirmed that the former president is prepared to remove “obstacles and unnecessary burdens” for the crypto industry. As the 2024 election approaches, the crypto sector is keenly watching the political landscape, hopeful for a regulatory environment that supports growth and innovation.