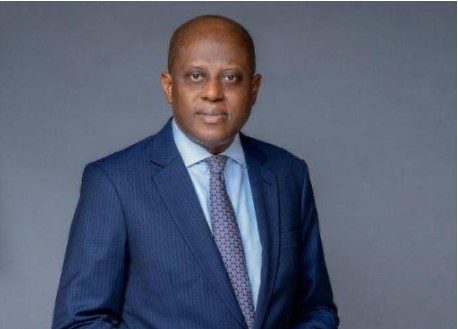

In a recent address at the 58th Annual Dinner of the Chartered Institute of Bankers of Nigeria, the Governor of the Central Bank of Nigeria (CBN), Dr. Olayemi Cardoso, announced plans to instruct Deposit Money Banks to augment their capital base.

This move is aimed at aligning the banking industry with President Bola Tinubu’s ambitious goal of achieving a $1 trillion GDP within the next seven years.

Dr. Cardoso acknowledged the need for collaboration among stakeholders and emphasized the importance of evaluating the adequacy of the banking sector to support the envisioned larger economy. He stated, “It is not just about its current stability.

We need to ask ourselves, can Nigerian banks have sufficient capital relative to the finance system needs in servicing a $1 trillion economy in the near future? In my opinion, the answer is no, unless we take action.”

Addressing the challenges faced by the apex bank, Dr. Cardoso highlighted issues such as corporate governance failure, diminished independence, deviation from the core mandate, inefficient forex rules, and a venture into development financing.

He expressed optimism that by implementing corrective actions and strategic measures, the CBN can restore macroeconomic stability and address fundamental flaws.

Dr. Cardoso also addressed the fluctuating exchange rate, pledging transparency and fairness in the central bank’s operations.

He welcomed recent government measures such as the removal of the petrol subsidy and the adoption of a floating exchange rate, anticipating positive effects on the economy in the medium term.

Acknowledging the CBN’s recent negative perception, Dr. Cardoso attributed it to various factors, including quasi-fiscal policies that injected over N10 trillion into the economy through intervention programs.

He assured that under his leadership, the CBN would tackle institutional deficiencies, restore corporate governance, strengthen regulations, and implement prudent policies to stabilize the economy.

The Chairman of the Body of Bank Chief Executive Officers, Ebenezer Onyeagwu, echoed optimism about the banking industry’s strength, particularly noting progress in dealing with the issue of FX forwards. Meanwhile, the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, emphasized the industry’s thriving and relatively healthy state, showcasing Nigeria’s financial offerings to the rest of the world.