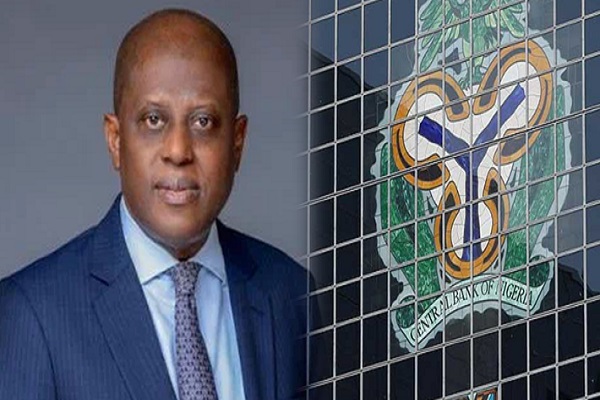

The Central Bank of Nigeria (CBN) has issued a stern warning to all primary mortgage banks (PMBs) across the country concerning the timely submission of regulatory returns.

In a press release published on its website dated March 5, referenced as FPR/DIR/PUB/LET/001/022, and signed by Dr. Valentine Ururuka, Director of Financial Policy and Regulation, the CBN expressed its dissatisfaction with PMBs’ tardiness in submitting periodic returns related to the Financial Institutions’ Annual reports.

The CBN clarified that a Primary Mortgage Bank is any company licensed to engage in primary mortgage banking business in Nigeria.

Emphasising the importance of adherence to regulatory guidelines for maintaining financial stability and transparency within the banking sector, the apex bank reminded PMBs of their vital role in the real estate and housing finance industry.

Specifically referencing Section 24 of the Banks and Other Financial Institutions Act 2020, the CBN highlighted the obligation of PMBs to submit their monthly Financial Institutions Annual (FinA) returns on or before the 5th day after the month-end.

The deadline ensures the CBN receives accurate and current information about the financial status of these institutions. PMBs are instructed to submit returns on the previous workday if the 5th day falls on a weekend or public holiday, accommodating any disruptions caused by non-working days.

The CBN warned of impending sanctions for future breaches of regulatory reporting deadlines, including fines, restrictions, or other disciplinary measures.

The statement emphasised, “All PMBs are therefore reminded of the provisions of Section 24 of the Banks and Other Financial Institutions Act 2020, and other extant regulations on timely rendition of regulatory returns.”

Furthermore, PMBs encountering technical difficulties preventing timely submission must promptly notify the CBN via email, including evidence of the technical issue, to facilitate resolution.

The CBN urges all PMBs to take these guidelines seriously and ensure the timely rendition of all regulatory returns, emphasising that failure to comply may have serious consequences for the banks and the overall financial system.