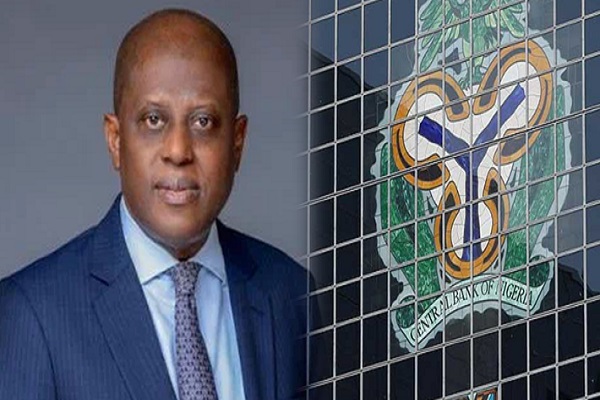

In an address at the ongoing International Monetary Fund Spring Meetings in Washington D.C., Central Bank Governor Olayemi Cardoso clarified the recent decline in the nation’s foreign reserves.

Contrary to widespread speculation, Cardoso emphasised that the depletion was primarily attributed to settling debts owed to international creditors, rather than being utilized to shore up the naira’s value.

Concerns had mounted among Nigerians as the country’s foreign exchange reserves witnessed a significant downturn, plummeting by approximately $2.16 billion over a span of 29 days, despite concerted efforts to stabilise the national currency.

Data sourced from the Central Bank of Nigeria’s website revealed that as of April 15, 2024, foreign exchange reserves stood at $32.29 billion, marking a stark decline from $34.45 billion recorded on March 18, 2024.

This decline, the lowest in six years, signals a departure from a period of consistent accumulation, during which reserves surged for 43 consecutive days, accruing $1.28 billion between February 5 and March 18, 2024.

Addressing the issue, Governor Cardoso underscored that the reduction in external reserves stemmed from fulfilling debt obligations, alongside other financial commitments inherent to the regular course of national economic activities, mirroring trends observed in other countries.

Importantly, Cardoso clarified that there were no intentions to utilise the reserves for defending the naira, dismissing such actions as counterintuitive to the nation’s economic strategy.

He stated, “I want to make this as clear as possible, it is not in our intention to defend the naira… The shift in our reserves reflects typical financial operations, including debt repayments, essential for maintaining credibility in the international arena.”

This statement from the Central Bank Governor sheds light on the rationale behind the recent fluctuations in Nigeria’s foreign reserves, reassuring stakeholders of the government’s commitment to prudent fiscal management.