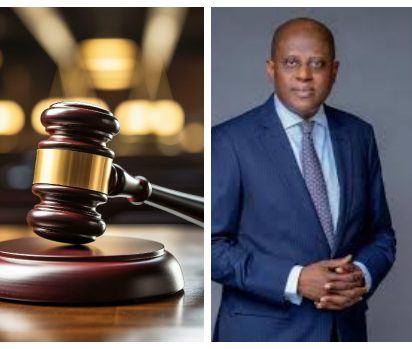

After thoroughly hearing both Kasmal International Services and the Central Bank of Nigeria on Stamp Duty payment outstanding to the collecting agent, a federal high court presided over by Judge Ekwo Inyang in Abuja, has ordered CBN, to pay about N579 billion with a 10 percent annual interest to the plaintiff.

The Judge’s decision comprises the judgment sum from January 1, 2015 to January 31, 2020, for Kasmal’s role in stamp duty collections.

Inyang Ekwo, the presiding judge, made the ruling on Friday, in a case instituted by Kasmal against the CBN and the attorney-general of the federation (AGF).

The interest will apply from January 1, 2015 to January 31, 2020.

The Journey To Here

During the hearing, Kasmal’s lawyer said it was appointed by the Nigerian Postal Service (NIPOST), to collect a N50 fee on all receipts issued by banks or financial institutions for services related to electronic transfers and teller deposits of N1,000 and above.

The appointment was in line with the Stamp Duties Act and the Nigerian Financial Regulations of 2009, court document said.

The lawyer argued that the terms of the agreement between NIPOST and the plaintiff included the remuneration of N7.5 from every N50 deduction of which his client’s percentage has not been fully paid as agreed.

“The plaintiff has become aware through public disclosures by the Governor of the CBN, that after the initial payment of N10.367 billion to the plaintiff, which did not reflect the total value of all accrued deposits that ought to have been paid into the 1st Defendant, NIPOST Stamp Duty Collection Account No. 3000047517 from January 1, 2015 to January 31, 2020,,” the court document reveals.

“Further remittances were made from the DMBs’ NIPOST stamp duties accounts to the 1st Defendant NIPOST Stamp Duty Collection Account No. 3000047517, in the tune of over N370.7 billion, which were amounts that accrued within the period from January 1, 2015 to January 31, 2020.

“Currently, a total of N3.8 trillion stands in the Stamp Duty Collection Account, ready for distribution among the Federal Government, State Governments, Local Governments, the Federal Inland Revenue Service (FIRS), Coordinating Consultants and other bodies.

“That the plaintiff’s 15%, amounting to N579,130,698,440, is part of the N3.8 trillion in the Stamp Duty Collection Account.

“The defendants/respondents have started taking steps to disburse and transfer the whole of the N3.8 trillion in the Stamp Duty Collection Account without the consideration of the outstanding payments due to the plaintiff.”

The lawyer then prayed the court to issue “an order directing the 1st and 2nd Defendants to pay the plaintiff the sum of N579,130,698,440, or any other sum as may be adjudged by this court upon the production of the records relating to the collection of stamp duty, between January 1, 2015 and January 31, 2020, representing 15% of all accrued deposits paid into or which ought to have been paid into the CBN NIPOST Stamp Duty Collection Account No. 3000047517, by all Deposit Money Banks”.

The plaintiff’s counsel also asked the court to restrain the first and second defendants from disbursing, transferring, “or doing anything whatsoever with all accrued deposits paid into or which ought to have been paid into the CBN NIPOST stamp duty collection account by all DMBs pending the hearing and determination of the case”.

Legality or Illegality of The Contract, Here is the Judge

In their preliminary objection to the suit marked FHC/ABJ/CS/335/2024, the AGF and the apex bank through their counsel, Adeniyi Akintola, told the court that the agency contract the plaintiff allegedly had with NIPOST was “illegal”.

Akintola argued that only the federal, state and local governments are entitled to share the revenue in the federation account.

“The non-joinder of NIPOST, which purportedly appointed the plaintiff as a collection agent, robs the Honorable Court of the requisite jurisdiction to entertain the claims as presently constituted,” Akintola said.

“The purported agency contract between NIPOST and the plaintiff, which is the basis for the plaintiff’s authority, is not placed before the court; hence the court cannot give effect to the said agency contract, merely because it was mentioned in passing in paragraph 5(e) of the plaintiff’s affidavit in support of the originating summons.

“The revenue being challenged belongs to the entire Federation, the collection and remittance of which goes to the Federation Account, and any amount standing to the credit of the Federation Account can only be distributed among the Federal, State, and Local Government Councils in each State. The court lacks jurisdiction to entertain this suit in relation to sharing the said money in the Federation Account.”

Delivering his judgment, Ekwo said the submission of the CBN and AGF that NIPOST lacks the statutory power to collect stamp duties “does not hold water”.

The judge said a previous judgment concerning stamp duty in favour of the plaintiff is still subsisting and has not been overturned by a higher court.

Ekwo said the submission of the CBN and AGF, that the reliefs sought by the plaintiff cannot be granted because all revenues accruing to the federation, including the stamp duties, are remitted into the federation account and can only be distributed among the tiers of government as provided in the constitution, is incorrect.

“I find at the end that the CBN and AGF have not effectively controverted the case of the plaintiff, and the plaintiff, having made a credible case, ought to succeed on the merit and I so hold,” the judge submitted.

“It is my opinion that this case is predicated on the fact that the 1st and 2nd Defendants have had transactions with the plaintiff before by paying the plaintiff the sum of N10.3 billion, being 15% of remitted stamp duty.”

Ekwo, therefore, granted the reliefs of the plaintiff and ordered the CBN to pay over N579 billion with associated interest within the stipulated period.