In response to the prevailing challenges posed by global inflation, the Central Bank of Nigeria (CBN) has announced a revision in the allowable limits of price deviation for imports and exports.

This adjustment, communicated through a circular addressed to all authorised dealer banks, signifies the CBN’s proactive stance in managing trade dynamics amidst economic uncertainties.

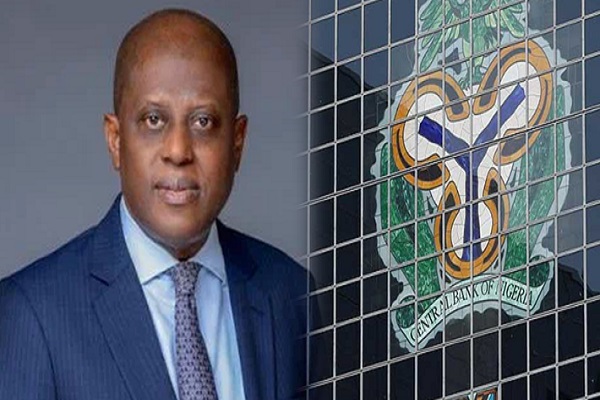

The circular, signed by Dr. Hassan Mahmud, Director of the Trade and Exchange Department, highlights the rationale behind the decision.

It elucidates that the permissible deviation for imports has been raised to +15% of the global average price, while exports are now capped at -15% of the global average price.

Price deviation, a statistical metric reflecting market price volatility, serves as a crucial indicator in trade monitoring. The CBN’s move underscores its commitment to ensuring fair and transparent trade practices while mitigating the adverse effects of inflation on the economy.

Moreover, the circular emphasises the CBN’s implementation of the Price Verification System (PVS) to address concerns regarding over-invoicing of imports and under-invoicing of exports. The PVS aims to curb excess outflows of foreign exchange resulting from price manipulation activities.

While the global inflationary outlook remains a concern, the International Monetary Fund (IMF) has projected a gradual decline in headline inflation rates. Notably, global headline inflation is forecast to decrease to 5.8% in 2024 and further to 4.4% in 2025, according to the IMF’s predictions.

The CBN’s directive underscores the importance of maintaining price stability in the face of evolving economic conditions. Authorised dealer banks and the general public are urged to adhere to the revised price deviation limits in line with regulatory guidelines.

By instituting these measures, the CBN aims to foster a conducive environment for trade and economic growth while safeguarding against potential risks associated with global inflationary pressures.