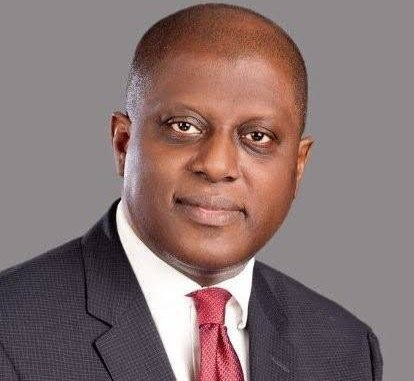

According to the Governor of Apex bank, Olayemi Cardoso, the Central Bank of Nigeria’s (CBN), efforts are beginning to show results in easing economic hardship.

The Senate convened the economic team, including the CBN governor, Minister of Finance Wale Edun, Minister of Budget and Economic Planning Atiku Bagudu, and Minister of Agriculture Abubakar Kyari, in order to address the pressing concerns such as the free fall of the Naira and soaring food prices.

During his appearance before the Senate Committee on Finance, Banking, Insurance, and Financial Institutions, Cardoso said, “Distinguished Senators, these measures, aimed at ensuring a more market-oriented mechanism for exchange rate determination, will boost foreign exchange inflows, stabilize the exchange rate, and minimize its pass-through to domestic inflation.

“Indeed, they have already started yielding early results with significant interest from Foreign Portfolio Investors (FPIs), that have already begun to supply the much-needed foreign exchange to the economy.

“For example, upwards of $1 billion in the last few days came in to subscribe to the Nigeria Treasury Bill auction of 1 trillion Naira which saw an oversubscription earlier this week.

Addressing the degradation of the Naira, Cardoso emphasized the effectiveness of measures aimed at fostering a market-oriented exchange rate mechanism. He asserted that these measures have already begun yielding early results, citing a significant influx of interest from Foreign Portfolio Investors (FPIs).

Notably, over $1 billion flowed into Nigeria’s economy in recent days through subscriptions to the Nigeria Treasury Bill auction, which was oversubscribed earlier in the week.

“Our efforts to bolster USD supply into the Nigerian economy hold considerable potential in mitigating exchange rate volatility,” Cardoso stated. However, he stressed the importance of moderating the country’s demand for foreign exchange to ensure the sustainability of these measures.