Bank of Industry – (BoI), at their annual public lecture, on Wednesday has reported some significant steps made across boards, to put Nigeria on the right path for growth, Olasupo Olusi – Managing Director (MD), said at the event.

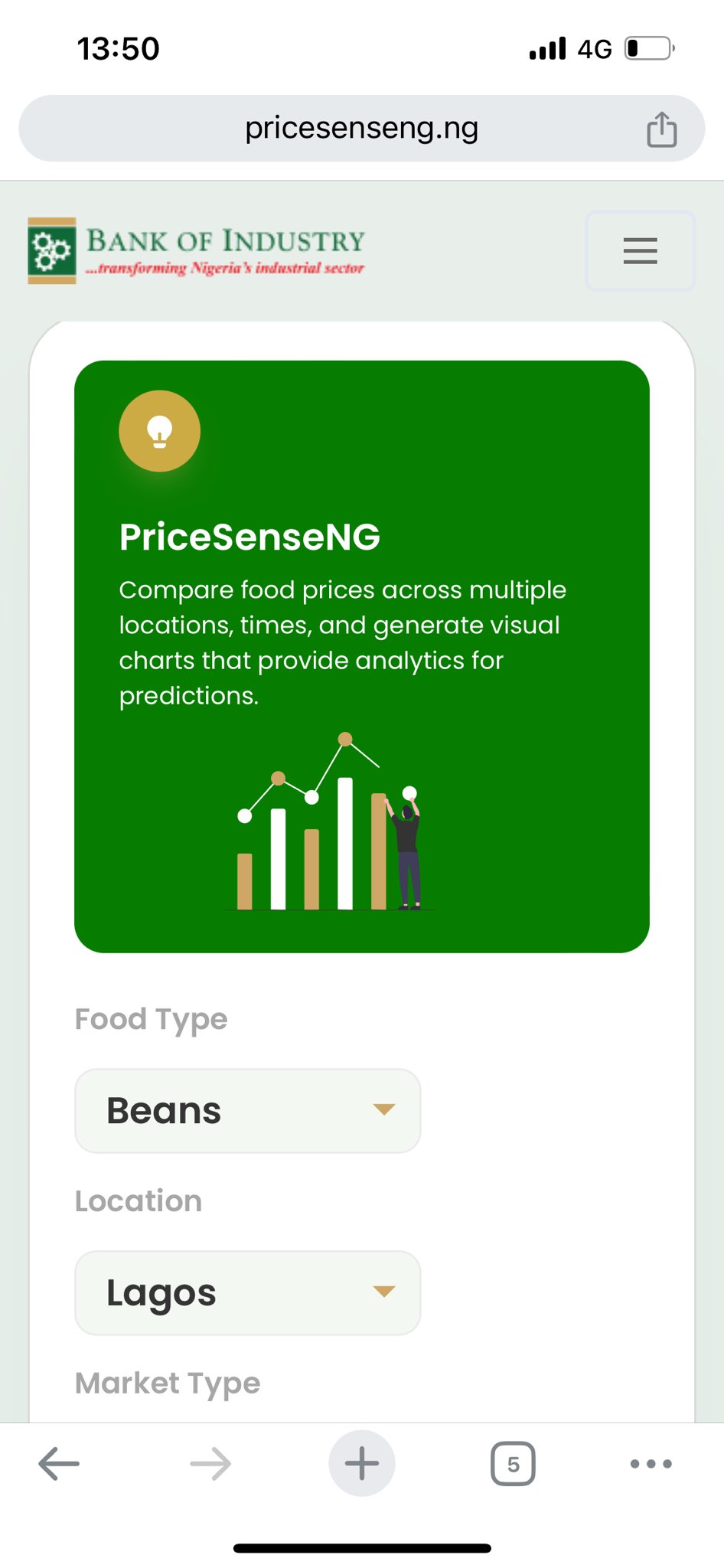

The Bank also at the event launched a mobile app, Pricesenseng, to check food prices in eight states in the federation of Nigeria.

Olusi presented “Pricesenseng” as a price intelligence dashboard and mobile app for real-time monitoring of price variations of food commodities such as rice, beans, tomato, maize and other daily consumables in different states across the country.

The event which was themed “Creating Impact: The Role of MSME Support and Financing in Alleviating Poverty and Food Insecurity in Nigeria.”

Speaking at the event, Olusi hinted on the available states in the app are, which are: Borno, Plateau, Rivers, Oyo, FCT, Lagos, Enugu and Kano.

On 1,000 MSMEs Receiving Almost N77.65BN

Olusi reviewed that between January and September, BoI has disbursed N77.65 billion to support close to 1,000 micro, small and medium enterprises (MSMEs), across the Nigeria.

Buttressing the reason for the banks’ action, he said “The MSMEs are the bedrock of any thriving economy.”

“In Nigeria, the MSMEs make up approximately 97% of all businesses contributing to over 80% of employment, and about 50% of GDP, and are the driving force of food production and the overall economic development in Nigeria.

Olusi, however, identified that the MSMEs are facing significant challenges, including limited access to finance, challenging operating environment and infrastructure deficiencies.

“Through sufficient financial support and enabling environment, MSMEs are better equipped to improve the socio-economic conditions of the poor by creating employment opportunities, promoting the utilization of local raw materials, and driving economic growth.

“So far this year, the bank has supported MSME across the country through the disbursement of loans totalling about N77.65 Billion.

“These loans were given to almost 1,000 MSMEs across the country to enable them boost their operations.

“Those who have benefitted through several of our financing facilities range from the local palm kernel oil processor in the east, to the woman with a printing press in the north, and a local furniture maker in the south, amongst others.”

Olusi maintained the bank will continually work to create an environment that fosters sustainable growth through access to capacity-building programmes, promoting technological innovation, and connecting businesses to domestic and international markets.

The bank’s MD said by empowering MSMEs with the tools and resources they need to thrive, the country is fostering a culture of innovation and entrepreneurship, driving job creation, poverty reduction, and inclusive economic growth.