Well, if this is the way to make the ATMs more effective as against been redundant as it’s presently experienced to empower PoS operators, good. But I don’t think it is the right time to do this. Nigerians are still lamenting over the skyrocket charges of telcos services, which kicks yesterday, and voom! CBN again!

It is necessary to be sensitive to the plight of the people, before rolling-out some policies, lest the government is perceived as putting on the shoe of ‘I don’t care’.

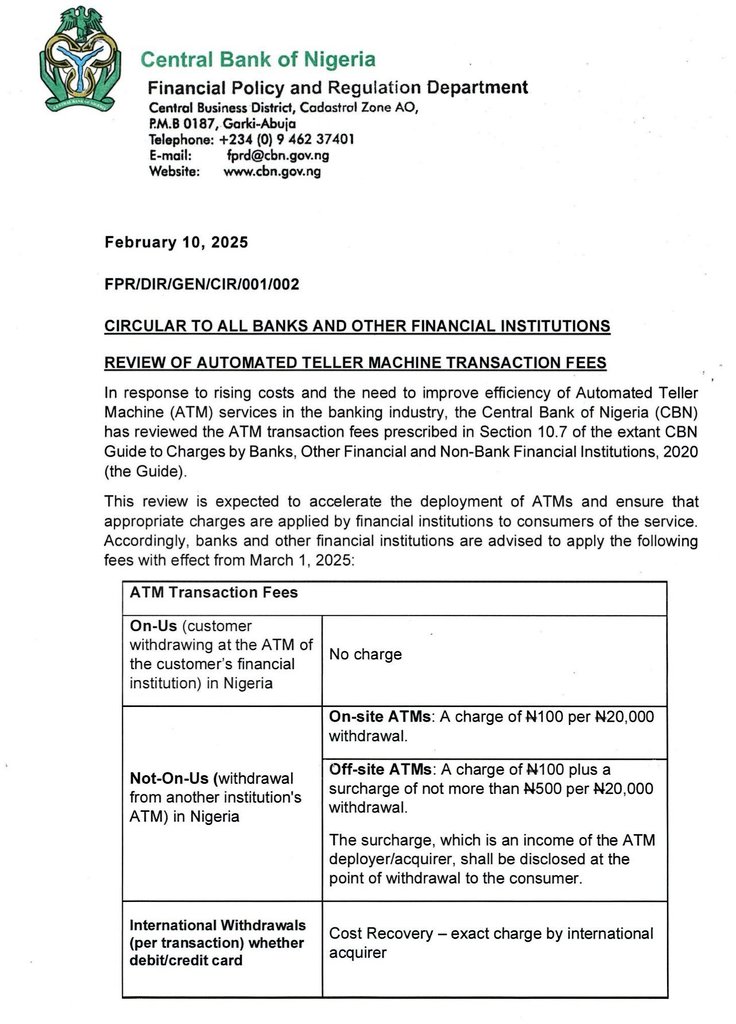

As the Central Bank of Nigeria (CBN), has announced a review on the transaction fees for automated teller machines (ATMs), via a circular which was signed by John Onojah, the acting director, financial policy and regulation department of the apex bank, and scheduled for implementation, March 1.

The regulator said the move would address rising operational costs and enhance efficiency in the banking sector.

Citing ATM transactions charges were last reviewed 6 years ago, 2019 precisely, when the CBN reduced the withdrawal fees from N65 to N35.

While the latest increase means Nigerians will pay more for more ATM transactions, the apex bank said the review is in line with Section 10.7 of the ‘CBN guide to charges by banks, other financial and non-bank financial institutions (2020)’.

“This review is expected to accelerate the deployment of ATMs and ensure that appropriate charges are applied by financial institutions to consumers of the service.

“Accordingly, banks and other financial institutions are advised to apply the following fees with effect from March 1, 2025.”

The the new policy states as follows:

- Customers withdrawing from their bank’s ATMs (on-us transactions) will continue to enjoy free withdrawals.

- However, a N100 fee per N20,000 withdrawal will be applied at on-site ATMs (those located at bank branches).

- For withdrawals at ATMs of other banks (Not-on-Us transactions), an off-site withdrawal will attract a N100 fee plus a surcharge of up to N450 per N20,000 withdrawal.

- The CBN clarified that the surcharge is the income of the “ATM deployer/acquirer and must be disclosed to consumers at the point of withdrawal”.

For international withdrawals using debit or credit cards, the CBN said banks and financial institutions are now permitted to apply “a cost-recovery charge equivalent to the exact amount charged by the international acquirer”.

“Furthermore, the three free monthly withdrawals allowed for Remote-On-Us (other bank’s customers/Not-On-Us consumers) in Nigeria under Section 10.6.2 of the Guide shall no longer apply,” CBN added.

The apex bank urged all financial institutions to comply with the new directives ahead of the implementation date.