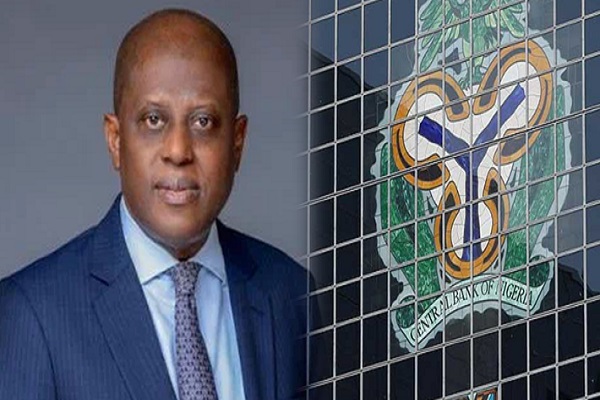

In a recent appearance before the House of Representatives Public Accounts Committee, the Central Bank of Nigeria (CBN) addressed queries regarding the operation of the Treasury Single Account (TSA) platform by Remita.

Hamisu Abdullahi, the Director of Banking Services at CBN, stated that Remita was chosen through a merit-based selection process to provide an electronic platform crucial for facilitating payments from Ministries, Departments, and Agencies (MDAs) to beneficiary accounts across commercial banks.

The selection of Remita came after rigorous evaluation, as highlighted by Salawu Zubairu, former Director of the Office of the Accountant General of the Federation (OAGF).

Zubairu noted that Remita demonstrated superior capabilities in handling electronic payments and collection of government receipts, meeting all stringent requirements set by the OAGF, CBN, and external consultants.

Managing Director of Remita Payment Services Limited, Mr. ‘Deremi Atanda, highlighted the positive impact of the TSA initiative, noting its evolution from manual to automated processes.

He explained how the previous system allowed MDAs to independently handle funds, leading to inconsistencies in remittances. With the TSA, transparency and accountability have been significantly improved, ensuring effective management of government cash assets.

The TSA has been instrumental in enhancing accountability within the civil service. Dr. Dasuki Arabi, Director-General of the Bureau of Public Service Reforms, reported that approximately 70,000 non-existent employees were uncovered and removed from the civil service payroll through the TSA.

Additionally, savings of at least N220 billion have been realized through the Integrated Payroll and Personnel Information System (IPPIS).

Mr. Atanda stated the government’s ability to track and account for every transaction through a unique Remita Retrieval Reference (RRR) code assigned to each revenue inflow.

The CBN reiterated that the selection of Remita for the TSA platform was not based on favoritism but on the company’s proven track record and capabilities in providing essential electronic payment solutions.