The Nigerian Senate has moved forward with a significant bill aimed at reforming the Central Bank of Nigeria Act, 2007.

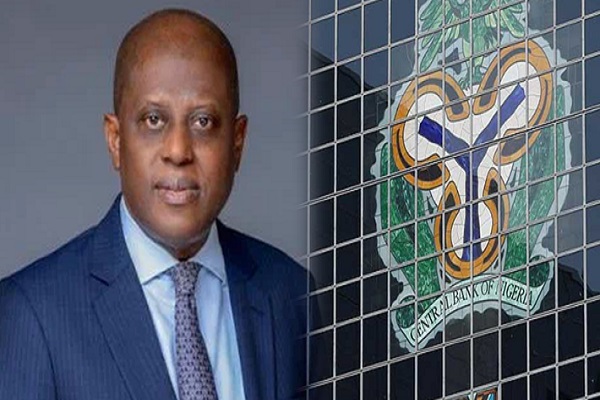

Sponsored by Senator Adetokunbo Abiru of Lagos East, along with 41 co-sponsors, the bill proposes substantial changes to enhance the effectiveness and governance of the central bank.

Key provisions of the bill include:

1. Single Non-Renewable Term for CBN Leadership: The bill suggests instituting a single non-renewable term of six years for the governor and deputy governors of the Central Bank of Nigeria, aligning with global best practices observed in institutions like the US Federal Reserve and the European Central Bank.

2. Limiting Temporary Advances to Federal Government: Temporary advances to the federal government, known as Ways and Means, would be restricted to not exceeding 10% of average government actual revenues over the preceding three years. This measure aims to prevent inflation and economic distortions caused by excessive advances.

3. Reforming Currency Redesign Policy: The bill seeks to address the challenges experienced by Nigerians during the naira redesign policy by ensuring the Central Bank provides reasonable notice of at least one calendar year before replacing existing legal tender. It also outlines a phased withdrawal of old legal tender to minimize disruptions to economic activities.

4. Strengthening Governance: The proposed amendments include changes to the composition of CBN Board Committees, advocating for non-executive directors to head these committees instead of deputy governors. Additionally, the bill introduces a coordinating committee for monetary and fiscal policies to enhance policy coherence.

Senator Abiru emphasized the necessity of updating the Central Bank Act to reflect evolving financial landscapes and ensure effective monetary policy implementation.

The reforms aim to align the central bank’s governance mechanisms with global standards while supporting Nigeria’s economic growth objectives.

The bill, titled “Bill for an Act to Amend the Central Bank of Nigeria Act, 2007 to strengthen the Bank, and for other related matters thereto, 2024 (SB. 325)”, signifies a crucial step towards modernizing Nigeria’s financial regulatory framework and fostering stability in monetary and fiscal policies.