Twenty-one states in Nigeria are seeking loans totaling N1.65 trillion to fund their 2024 budget deficits, despite a significant increase in their allocations from the Federation Account Allocation Committee (FAAC) over the past year.

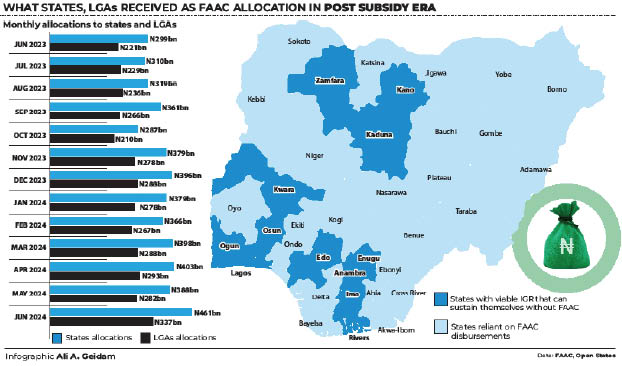

From June 2023 to June 2024, all 36 states and 774 local governments in Nigeria received a total of N7.6 trillion from FAAC. This surge in revenue was largely due to the federal government’s removal of the petrol subsidy on May 29, 2023.

According to findings by Daily Trust, the 36 states are projected to receive N5.54 trillion from FAAC in 2024, compared to the N3.3 trillion disbursed to them in 2023.

Under the current revenue-sharing formula, the federal government receives 52.68% of the total revenue, while states receive 26.72% and local governments receive 20.60%. These revenues, combined with internally generated funds, are intended to support development across all three tiers of government and enable them to meet their financial obligations.

Supreme Court Upholds Financial Autonomy for Local Governments

Despite these allocations, the financial autonomy of local governments remains a contentious issue. In June 2024, FAAC allocations to local governments were paid directly to state governments. However, on July 11, 2024, the Supreme Court affirmed financial autonomy for local governments, directing that the financial allocations for all 774 local government areas be paid to them directly. The Court ruled that it is unconstitutional for state governments to manage these funds on behalf of local governments.

Daily Trust investigations reveal that 21 states have expressed intentions to borrow N1.65 trillion from both internal and external sources to cover their 2024 budget deficits. Some states have not yet disclosed their borrowing plans. Among those that have, Adamawa plans to borrow N68.46 billion, Anambra N245 billion, Bauchi N59.08 billion, Bayelsa N64 billion, Benue N34.69 billion, Borno N41.71 billion, Ebonyi N20.5 billion, Edo N42.71 billion, and Ekiti N27.15 billion. Others include Jigawa (N1.78 billion), Kaduna (N150.1 billion), Kebbi (N36.7 billion), Katsina (N163.87 billion), Kogi (N37.08 billion), Kwara (N30.76 billion), Osun (N12.36 billion), Oyo (N133.4 billion), Nasarawa (N32.93 billion), Gombe (N73.75 billion), Enugu (N103 billion), and Imo (N271.34 billion).

FAAC Allocations Rise Significantly

Over the past year, FAAC allocations to the 36 states and 774 local governments increased by more than 40%, reaching N7.6 trillion. Monthly allocations varied, with states receiving between N287.07 billion and N461.979 billion, while local governments received between N210.90 billion and N337.019 billion.

Allocations from Value Added Tax (VAT) also saw a significant increase, rising 228.8% year-on-year to N2.42 trillion in the first five months of 2024, up from N736.06 billion in the same period in 2023. Similarly, the 13% derivation fund for oil-producing states rose by 234%, from N155.5 billion in the first five months of 2023 to N519.83 billion in the same period in 2024.

Experts are calling for increased accountability in the use of these funds. Umar Yakubu, Executive Director of the Centre for Fiscal Transparency and Public Integrity, emphasised the need for robust accountability mechanisms to ensure that increased revenues are used effectively. He noted that despite the revenue increase, many states have not increased hiring, pensions, or capital expenditures, raising concerns about potential misuse of funds.

Victor Agi, a development expert, echoed these sentiments, highlighting the need for state governments to be more transparent and accountable with their increased revenues to foster grassroots development.

He noted that, despite a nearly 50% increase in revenues, many state governments have not improved worker welfare or general public services. Agi called for greater awareness and advocacy from civil society to ensure that, the increased revenues lead to tangible development outcomes at the local level.